Loan Application Process

Become a Member

Join the Credit Union and avail of numerous tailored benefits, outstanding customer service and amazing community

Calculate your Loan

Estimate how much you could borrow and calculate your repayments: weekly, fortnightly, or monthly using our online calculator

Apply for a Loan Online

Apply for your loan from the comfort of your home with our new online loan application. Upload all your loan documents through our mobile app - no paper no stress!

Sit back and relax

Voilá! You are done! Our team are now reviewing your application, we will be in touch shortly to confirm your loan application.

Mortgage 5% (5.12% APR)

Representative Example

A representative example is a term used in financial regulations. The example will help to show you the typical costs associated with a loan for a certain amount.

Loan Amount€120,000 | Loan Term30 years | Rate of Interest - APR5.12% |

Monthly Repayment€644 | Total Interest€111,904 | Total Cost of Credit€231,904 |

Maximum Loan Term :

5.12%

5.12%

5.12%

This calculator is for illustrative purposes only, to give you, the borrower, an overview of the potential cost of borrowing. The Credit Union, or any of its staff, cannot be held responsible for any errors. Please note that this calculator only provides an indicative quote and actual repayments may vary.

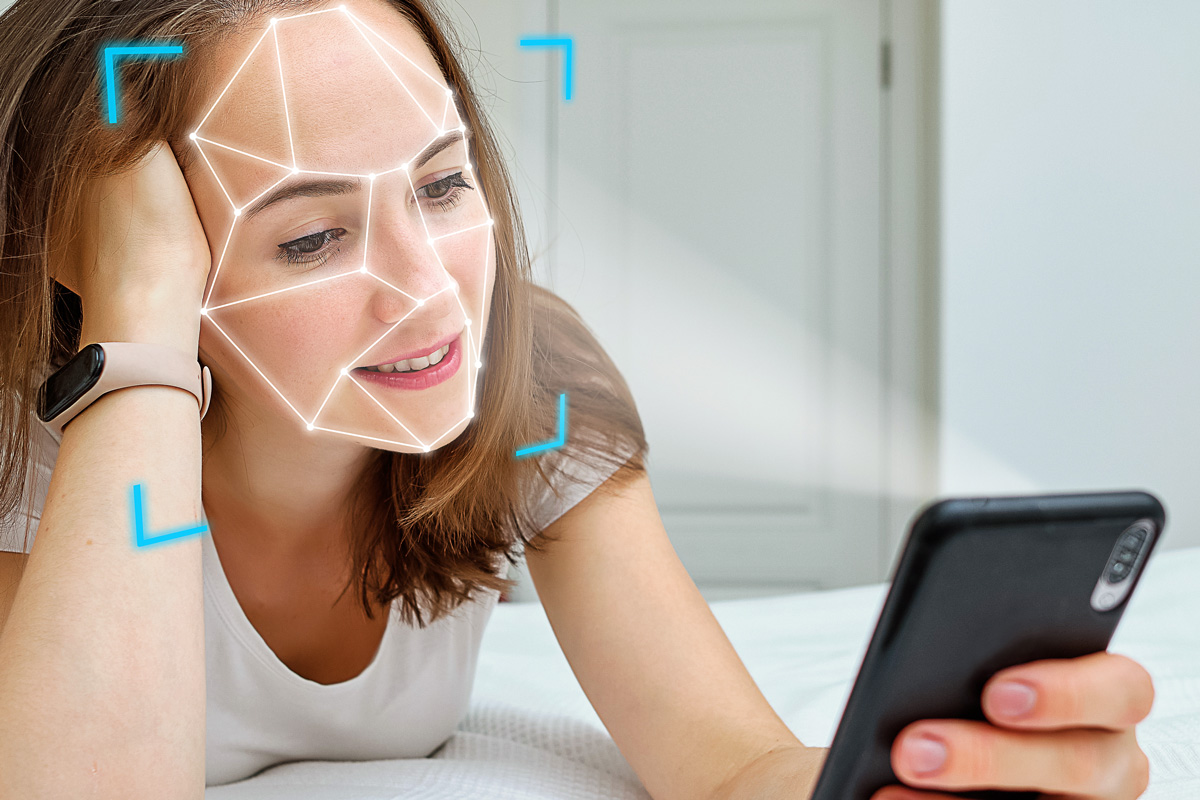

Join using your Phone

We’ve created an intelligent and secure method for you to become a member directly through your mobile phone. All you have to do is download our Mobile App, for free, to take full advantage of joining as you go.

Loan Limits

Loan To Value (LTV limits)

For principal private residences: From 1/1/17

- First Time Buyers: 90%

- Non-First Time Buyers: 90%

Loan To Income Limit

For principal private residence:

- 3.5 times income

What you need to Apply

Proof of income in accordance with the Lending Policy

- the applicant’s ID and ability to pay have been established with reference to original documentation

- CCR checks

- Judgement checks

- The independent valuation report

Household Debt Service Ratio % on the basis of the current interest rate stressed-tested for a 2% rate rise

Conditions attaching to the application including:

- perfection of security

- property insurance arrangements

- the Mortgage Loan meets the member(s) needs and objectives;

- the outcome of the assessment of affordability shows that the member(s)

- is likely to be able to meet the loan repayments on an ongoing basis;

- is financially able to bear any risks attaching to it;

- has the ability to repay the loan on the terms of the credit agreement

- the product or service is consistent with the member’s attitude to risk.

A draft of the Suitability Statement will be provided to the member(s).